How to Choose Insurance for Your Classic Car

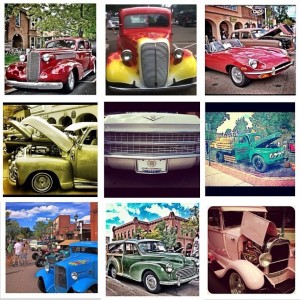

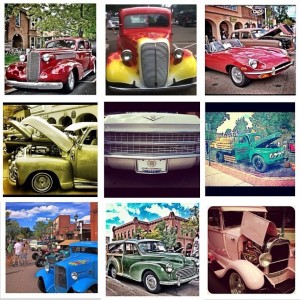

When it comes to cars, it’s hard to beat the classics. There are a number of popular classic cars, from the Chevy Camaros and Ford Mustangs of the 1960s, to the classic cars of the 1950s, including the Chrysler D’Elegance and the Oldsmobile F-88. And, of course, it’s impossible not to harbor a soft spot for cars like the 1941 Chrysler Thunderbolt and the futuristic 1954 Pontiac Bonneville Special.

Your classic car needs protection, though. A lot of love – and money – often goes into restoring classic cars, and it’s important to make sure that you purchase the right insurance for your baby.

Specialty Car Insurance vs. Standard Car Insurance

Insuring a classic or specialty car via standard car insurance can be a bit expensive. Many “regular” insurance companies charge higher premiums to cover classic cars. If you are hoping for a better rate, it is possible to consider a specialty car insurance policy.

A specialty car insurance policy can cover your classic car, and provide you with a less restrictive policy. Shop around, and make sure you include specialty insurance policies in your calculations. One of the best reasons to consider specialty car insurance for your classic car is that those handling the claims know more about collector vehicles and classic cars. A knowledgeable insurer can be worth a great deal more than any premium you pay.

Choosing Your Classic Car Coverage

Often, owners of classic cars have special needs. As you shop around for auto insurance coverage, choose a company that covers the following situations:

- Damage resulting from car shows

- Liability coverage while you attend club events

- The ability to use your own mechanic for repairs to your classic car

- Coverage while the car is restored

- Coverage during transport if you have the car shipped (make sure this includes overseas shipping, as well as state-to-state shipping)

You can also look for a certain flexibility in the premiums, based on how many miles the car is actually driven. If you don’t drive your classic car very much, you might be able to negotiate a slightly lower rate on your premiums.

Another thing to pay attention to is how your classic car is covered if a total loss is involved. When it comes to classic cars, there are three different terms used to determine the insurance payout:

- Actual Cash Value (ACV): Watch out for this coverage, since it usually bases the payout on the same formula used for “regular” cars, and involves a depreciated book value. Your classic car might just be classified as “old” in this case, and you wouldn’t receive what you think it is worth.

- Stated Value: Another option is to negotiate a payout based on stated value. This is often used in the case of collectibles, and your classic car might qualify. You state the value of the car, and that is the payout. However, you should re-evaluate regularly when you use this method, since it won’t account for appreciation in the value of your classic car.

- Agreed Value: This is the best policy if you are looking to get all of your money back. This process involves agreeing on what your classic car is “worth.”

Carefully consider your insurance options, and be picky. You want to make sure that your classic car investment is properly protected.

Chevy Corvette Insurance Factors

5 Factors that Affect Your Chevy Corvette Insurance Premiums

One of the coolest cars out there is the Corvette. The Corvette brand is known around the world and, since its introduction in the 1950s, has often been the face of American sports cars. The Corvette has gone through six generations, and the rumor is that another version has been in development since 2007.

Corvette owners take pride in their cards, from astronaut Alan Shepard to talk show host Jay Leno to musician Sheryl Crow. However, if you own a Corvette, you do need to pay to insure it. The good news is that insuring a Corvette is often cost-effective when compared to other sports cars.

The average cost to insure a Corvette, according to Automotive.com, is $1,887 a year. (Compare that to $3,000 a year to insure a Porsche 911.) However, it’s possible to pay less than that, depending on various factors. Here are 5 factors that will affect your Chevy Corvette insurance premiums:

1. Your Driving History

The most important factor in obtaining a lower insurance rate for your Corvette is your driving history. According to the Insurance Institute for Highway Safety, Corvettes have few claims filed against them. It looks as though Corvette owners are generally safe drivers – and that is one of the reasons that it is possible to find insurance that is at least manageable. If you have a pristine driving history, you might even be able to find a policy as low as $700 or $800 a year.

2. Where You Live

Your location matters when it comes to auto insurance premiums. If you live in an area that has a high incidence of car accidents, your insurance is going to be higher, whether you have a Corvette or another type of car. Another issue is whether or not car theft is common in your area. An area prone to high-end car thefts can mean a higher premium for you.

3. The Actual Insurance Policy

The insurance policy you choose to cover your Chevy Corvette can impact your premium. Choose a higher deductible, and you could end up with a lower premium. Because Corvettes are American cars, finding the parts to repair them is often easier than getting the parts for foreign sports cars. Choose a higher deductible, and consider the actual coverage you need, and you will likely see a lower premium.

4. How Much You Drive Your Corvette

Frequent drivers are more likely to get in an accident. If you garage your Corvette most of the year, and only drive it a few thousand miles annually, you could get a break on your insurance premium. Most Corvette drivers don’t take their cars to work each day, and that can mean a lower insurance rate.

5. Your Demographics

Your age and gender can also influence your insurance premium. A single man in his early 20s is likely to be considered a larger accident risk than a middle-aged mom. As a result, insurance rates – especially on a cool, sporty car like a Corvette – can be higher for certain demographics. Look for ways to offset these costs by boosting your deductible, or showing your good driving history.

Among sports cars, the Chevy Corvette is one of the most affordable in terms of insurance. You can make the most of your driving experience by paying attention to the factors that determine your rate, and taking steps to save as much as you can on insurance premiums.