The Benefits of having Honda Civic Insurance

The Honda Civic is one of the most popular cars on the road today. Many consumers are turning to Honda for their sharp look and smooth handling skills. Just as there are consumers who enjoy the vehicle for its aesthetic value, they also like the quote they receive from their insurance agency.

Here are some things to look for when choosing an insurance policy that fits your needs:

- Underinsured – This is one of the most important things to add to your policy because it could end up saving you lots of money in the long run. Underinsured means that when and if someone else hits you, you will be covered even though they do not possess enough insurance to cover the accident.

- Personal Injury Protection – This is usually referred to as PIP. All that means is you will have so much money to go to the hospital in the event of an accident. You can chose to take a number of different deductibles, but most and general ones start at $1,000. That means that you have to come up with the first thousand before a surgery or medical bills; whichever one comes first.

- Property Damage – This could end up hurting you more than an accident itself if you chose not to put it on your policy. This type of protection will give you the satisfaction you deserve. If you have ever damaged someone else’s property in an accident, you know this could really help you. It covers the damages incurred by the accident such as a home or guide rail.

- Rental – You may want to think about this one, especially if you only have one car in your family. Rental can end up being your best friend after an accident. It allows you to take out a rental vehicle while your vehicle is being repaired. The one main thing that it does is provides peace of mind.

- Towing – This can get really expensive and time consuming if you don’t add it to your policy. Accidents happen when you don’t expect them, and some of them can be really damaging to your vehicle. That’s why insurance agencies offer towing on their policies. You may think that you will never need this, but think again because you just might.

The Honda Civic is a great coupe that is very affordable and looks sporty. But the one main thing to consider is the insurance. You can get a great rate just from researching multiple companies online as that can make the difference between liking your Civic and loving it.

There are many things to choose from when checking out a policy, especially price. But think of it this way, the more you pay now the less you’ll have to pay if you get into an accident. Insurance is protection that provides a sense of security for you and your family. Start researching policies today and start enjoying your Civic.

BMW Insurance That Will Save You Money

Hey let’s face it, owning a BMW is a luxury, especially in today’s economy. The last thing you need, besides high car payments, are outrageous insurance payments. Yes, you may pay a little bit more for owning such a fine piece of machinery, but you also want to save money. Depending on which type of BMW you have, the insurance can differ.

Here are some different types of the classy looking vehicle:

- Coupes – The BMW 1 series is a basic coupe where basic means nothing out of the ordinary. They come in several varieties, and the insurance rates for them can be quite a bit lower than the other styles. Just ask an insurance provider for more details as you’ll want to have good coverage for this stylish car.

- Convertible – This is a vehicle for drivers who have not yet experienced the wind in their hair. The BMW convertible is a much smaller vehicle, which means you are more prone to damaging it in an accident. You’ll want to have all of your bases covered with this little gem such as full coverage, which in terms of comprehensive means that if your car is damaged that it can be repaired with a small out of pocket expense.

- SUV – The BMW sport utility vehicle is one of the most popular vehicles on the road today as it offers a safe driving experience for you and your family. Car insurance for this does not have to empty your bank account as long as you chose the right provider. This vehicle offers safety in the form of anti lock brakes and air bags that surround you on all sides. Having these on the vehicle as well as an ant theft system will end up saving you lots of money on your coverage. Remember, the more safety features that your vehicle offers the more you are going to save in the long run.

- Sedans – The main purpose of a sedan is to offers a four door setting while giving you the comfort of having more room in your car. It also means that your insurance can be much lower. That means you will be much happier by owning one of these. Four door vehicles are normally inexpensive in terms of car insurance because they are less of a liability on the roads. When choosing vehicle insurance for your new sedan, make sure that you always carry underinsured. This type of policy will make sure that your vehicle is covered when the person who hits you doesn’t have full coverage.

There are many factors to decide on when choosing which BMW to purchase. You are going to want insurance coverage that covers you and your family along with anybody else who drives the vehicle. By covering your family, you are blanketing them with a sense of protection for when the inevitable happens. So make sure that you have enough protection just in case. You’ll feel much safer and so will your family.

Hyundai Insurance

The Hyundai is one the most common cars on the road today. This is due to their affordability and looks. But the one main reason that consumers buy them for is their inexpensive insurance. The economy is not doing so well anymore, so the last thing that you want to do is pay high insurance rates.

Although the Hyundai is one of the best vehicles on the road, you may want to take a look at the insurance rate for them as they have competitive rates for any of their types. The rates may all depend on whether the vehicle is a six or an eight cylinder.

Here are some great things to add to your insurance policy to ensure that you are getting the most from it:

- Good Student Rates – The Hyundai is a great car for any age, especially for those who are just starting out as they are safe and really reliable. If you have a teenager who has just started driving, you may be eligible for a lower rate. There are stipulations though; your child has to be a good student with a high GPA.

- GAP Insurance – You may ask what this is. Well, that’s a good question because many people don’t know that much about it or are unaware that it exists. GAP insurance is extra insurance for the total loss of a car. If you get into an accident and are making car payments, this insurance may help you in getting the loan paid off. It’s peace of mind for those who have suffered a loss.

- Extra Driver Discount – Many insurers are now offering the extra driver discount as part of their policies. This is great for when there are many people in the household who drive. The more drivers you add to a policy the more you are going to get it lowered. So you, your husband and children all can drive the same vehicle and pay less.

- Rental and Towing – These two things are a must for drivers. They help out greatly when an accident occurs. Also, you won’t have to call a tow driver or look for one at the last minute as this is something that a representative will help you with at the time of need. Plus, rental is perfect. You can have another vehicle by the next day after reporting your accident. So while you’re waiting for your car to get done at the shop, you can be driving around in your rental.

- Injury Protection – This is something really important to look into because it may save your life for when an accident happens. Personal injury takes care of a percentage of all your medical bills that are accrued during an accident. They will even help pay for a surgery once you cover the deductible.

These are some things that you may want to add to your insurance policy on your brand new Hyundai. Always practice safe driving when on the roads.

How to Estimate the Cost of Car Insurance

Car insurance is an important thing to have nowadays. With so many uninsured motorists on the road, you need coverage in case the inevitable happens. Insurance has been on the rise throughout the last few years. You should be looking for maximum coverage for a low price.

Different types of vehicles require different policies. These policies can range from minimum to full coverage. That’s something that you should always keep in mind. The choice is yours to decide which type of policy you need, but choosing which one can be quite difficult.

Here is a list of vehicle types that makes a policy fluctuate:

- Sports Cars – The sportier a vehicle is, the higher the policy will be. Those who decide to go with a sports car are more at risk for accidents due to the speed that the car has. Those models are BMW, Jaguar, Mercedes, Corvette and Camaro. You should expect to pay a higher premium with an insurance company by going with ones of these types. Another thing to remember is that insurance is higher is due to repair costs.

- Sedans – Sedans are the most popular type of vehicle on the road today. Most of them are affordable and great on gas mileage. Repair costs associated with sedans are moderate as they don’t break down much with typical maintenance care such as oil and tire changes. You will save money on your insurance with this type.

- Trucks – Trucks are treated just like cars in this case. The only exception is the larger the truck, the more you should expect to pay in insurance. Larger trucks tend to bully the roads and are built tough. That means they are durable and able to withstand loads of pressure. But if you’re going with a smaller truck that is a four cylinder, you won’t pay much out of pocket.

- SUVs – SUVs are a fusion of a car and truck combination. They are what most people with families are driving on the roads today. They are sporty and really good on gas. Most people chose them for their looks and not insurable rates. They tend to be on the higher range because of maintenance care and other repairs that are necessary.

If you’re looking to get a good rate, you should always do some research. Those who compare rates tend to get the best ones. You should never pick the first one you call because there are probably several that can save you money. You just have to hunt for them.

So many companies are offering good deals for different things. They offer these benefits so you will obviously go with their company, but always read the fine print of a policy. They may offer you a deal now but rates may go up in a year. Always look for these things.

Here are some benefits that some car insurers offer:

- Vehicle Cameras – Some companies now have cameras that they put in your car to monitor your driving. You may be wondering why they are doing this. It’s so they will be able to lower your insurance if you are a good driver.

- First Time Rates – Estimates can be rather high for those who are just starting out. New drivers tend to be a risk to others on the road. Many companies are offering deals for young drivers who take a safety course prior to obtaining insurance. Those who can maintain a good driving record can expect their insurance to drop.

- Senior Rates – There are more seniors on the road today due to the economy’s effect on their lives. They are now forced to go back to work in order to make ends meet. Many companies understand this and are making an attempt to lower rates for seniors. There are some stipulations such as being off the road before a certain time in the evening and renewing their license every year.

- Accident Free Rates – This is what many car insurance companies are selling currently. They recognize good driving and want to reward you for it. That’s why these policies have become so popular. They know it’s not fair for a bad driver to pay the same premium as someone who is driving well. Those who don’t have any accidents can expect to pay very little for their insurance.

These are just some of the benefits that insurers are offering. There are many more; you will just have to research them online. If you do happen to find a company that has good rates, you may want to consider covering all the drivers in your home. This is great for anyone that tends to drive the same vehicle.

Here are some best tips on how to get a good estimate:

- Driving Record – When looking for a new company, always keep in mind the one factor that will determine how much you’re going to pay for car insurance, and that is your driving record. If you’ve had too many accidents or speeding tickets, you will pay for it. Companies are held liable for your actions and have to pay other companies if and when you have an accident.

- Make Calls – Phone calls are much more personable than talking to someone online. Many companies will offer you a good deal if you call them. They like face to face interaction. Most people do not deal with phone calls anymore due to technology. They want instant quotes without having to speak with anyone.

- Compare Online – So many insurance companies are now based online. They offer good deals for people who sign up electronically because of the convenience. More car insurance companies are taking this route so they can advertise on social media forums.

Call today and sign up to get the best estimate that they can give you. You’ll be driving safely in no time. So stop waiting and get insurance that matters. It may save your life.

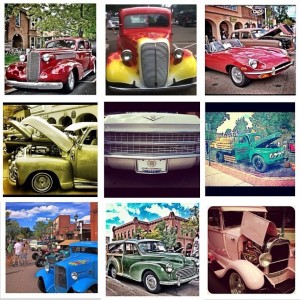

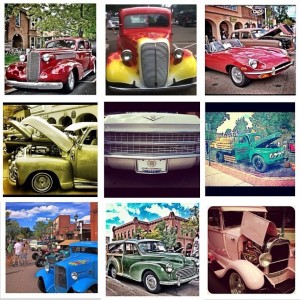

How to Choose Insurance for Your Classic Car

When it comes to cars, it’s hard to beat the classics. There are a number of popular classic cars, from the Chevy Camaros and Ford Mustangs of the 1960s, to the classic cars of the 1950s, including the Chrysler D’Elegance and the Oldsmobile F-88. And, of course, it’s impossible not to harbor a soft spot for cars like the 1941 Chrysler Thunderbolt and the futuristic 1954 Pontiac Bonneville Special.

Your classic car needs protection, though. A lot of love – and money – often goes into restoring classic cars, and it’s important to make sure that you purchase the right insurance for your baby.

Specialty Car Insurance vs. Standard Car Insurance

Insuring a classic or specialty car via standard car insurance can be a bit expensive. Many “regular” insurance companies charge higher premiums to cover classic cars. If you are hoping for a better rate, it is possible to consider a specialty car insurance policy.

A specialty car insurance policy can cover your classic car, and provide you with a less restrictive policy. Shop around, and make sure you include specialty insurance policies in your calculations. One of the best reasons to consider specialty car insurance for your classic car is that those handling the claims know more about collector vehicles and classic cars. A knowledgeable insurer can be worth a great deal more than any premium you pay.

Choosing Your Classic Car Coverage

Often, owners of classic cars have special needs. As you shop around for auto insurance coverage, choose a company that covers the following situations:

- Damage resulting from car shows

- Liability coverage while you attend club events

- The ability to use your own mechanic for repairs to your classic car

- Coverage while the car is restored

- Coverage during transport if you have the car shipped (make sure this includes overseas shipping, as well as state-to-state shipping)

You can also look for a certain flexibility in the premiums, based on how many miles the car is actually driven. If you don’t drive your classic car very much, you might be able to negotiate a slightly lower rate on your premiums.

Another thing to pay attention to is how your classic car is covered if a total loss is involved. When it comes to classic cars, there are three different terms used to determine the insurance payout:

- Actual Cash Value (ACV): Watch out for this coverage, since it usually bases the payout on the same formula used for “regular” cars, and involves a depreciated book value. Your classic car might just be classified as “old” in this case, and you wouldn’t receive what you think it is worth.

- Stated Value: Another option is to negotiate a payout based on stated value. This is often used in the case of collectibles, and your classic car might qualify. You state the value of the car, and that is the payout. However, you should re-evaluate regularly when you use this method, since it won’t account for appreciation in the value of your classic car.

- Agreed Value: This is the best policy if you are looking to get all of your money back. This process involves agreeing on what your classic car is “worth.”

Carefully consider your insurance options, and be picky. You want to make sure that your classic car investment is properly protected.

Chevy Corvette Insurance Factors

5 Factors that Affect Your Chevy Corvette Insurance Premiums

One of the coolest cars out there is the Corvette. The Corvette brand is known around the world and, since its introduction in the 1950s, has often been the face of American sports cars. The Corvette has gone through six generations, and the rumor is that another version has been in development since 2007.

Corvette owners take pride in their cards, from astronaut Alan Shepard to talk show host Jay Leno to musician Sheryl Crow. However, if you own a Corvette, you do need to pay to insure it. The good news is that insuring a Corvette is often cost-effective when compared to other sports cars.

The average cost to insure a Corvette, according to Automotive.com, is $1,887 a year. (Compare that to $3,000 a year to insure a Porsche 911.) However, it’s possible to pay less than that, depending on various factors. Here are 5 factors that will affect your Chevy Corvette insurance premiums:

1. Your Driving History

The most important factor in obtaining a lower insurance rate for your Corvette is your driving history. According to the Insurance Institute for Highway Safety, Corvettes have few claims filed against them. It looks as though Corvette owners are generally safe drivers – and that is one of the reasons that it is possible to find insurance that is at least manageable. If you have a pristine driving history, you might even be able to find a policy as low as $700 or $800 a year.

2. Where You Live

Your location matters when it comes to auto insurance premiums. If you live in an area that has a high incidence of car accidents, your insurance is going to be higher, whether you have a Corvette or another type of car. Another issue is whether or not car theft is common in your area. An area prone to high-end car thefts can mean a higher premium for you.

3. The Actual Insurance Policy

The insurance policy you choose to cover your Chevy Corvette can impact your premium. Choose a higher deductible, and you could end up with a lower premium. Because Corvettes are American cars, finding the parts to repair them is often easier than getting the parts for foreign sports cars. Choose a higher deductible, and consider the actual coverage you need, and you will likely see a lower premium.

4. How Much You Drive Your Corvette

Frequent drivers are more likely to get in an accident. If you garage your Corvette most of the year, and only drive it a few thousand miles annually, you could get a break on your insurance premium. Most Corvette drivers don’t take their cars to work each day, and that can mean a lower insurance rate.

5. Your Demographics

Your age and gender can also influence your insurance premium. A single man in his early 20s is likely to be considered a larger accident risk than a middle-aged mom. As a result, insurance rates – especially on a cool, sporty car like a Corvette – can be higher for certain demographics. Look for ways to offset these costs by boosting your deductible, or showing your good driving history.

Among sports cars, the Chevy Corvette is one of the most affordable in terms of insurance. You can make the most of your driving experience by paying attention to the factors that determine your rate, and taking steps to save as much as you can on insurance premiums.

What is the Cost of Auto Insurance after DUI?

The cost of auto insurance after DUI convictions can be crazy, if you can even get coverage at all. You may even find that if you have a DUI conviction that your coverage gets cancelled all together. This means that even if you have received your driving privileges back you may still not actually be able to drive because you can’t get any insurance. Drivers all across the United States are required to carry a certain amount of auto insurance coverage, except for residents of New Hampshire. This means that you will have to find an insurance company that will give you coverage at a price you can afford.

Your Fees will be High

You are going to have a lot of bills waiting for you after a DUI conviction. In addition to the extra cost of auto insurance after DUI, you will probably also have a number of other expenses, including, but not limited to:

- Fines

- Penalties

- Vehicle towing and impound

- Alcohol education classes

- Victim restitution

- DMV licence reissuing fees

- Booking, fingerprinting and photo fees

- Attorney and other legal fees

All of these fees can add up to thousands of dollars, and that is not including the extra costs you are going to have to pay in order to reinstate your auto insurance. This is reason enough to make sure that you never make the mistake of drinking and driving. There is also the chance that you could end up injuring or killing yourself or others.

Discounts You May be Eligible For

Finding an insurer who will help keep the cost of auto insurance after DUI as low as possible is difficult in itself, and you can’t expect to be able to find very good rates. But, there are some insurance companies that will deal with you, and they will work with you to make sure that you get the best rates possible given your situation. You may actually be able for some other discounts that will help you save a little bit on the rates, such as:

- Combining home, auto and life insurance policies

- Maintaining a good credit rating

- Taking driver education courses

You will also need to ask about getting SR-22 insurance coverage. You should contact both standard and non-standard carriers to find out who is offering the best rates for this type of policy.

Even with these discounts, including SR-22 coverage, your insurance rates are still going to be pretty high if you have had a DUI conviction. This is why you need to shop around and contact as many insurance companies as possible. They don’t all charge the same rates, and some are more lenient about covering drivers with such convictions than other insurers are. If you have been convicted of a DUI, you need to find ways to get the insurance you need as required by the law in your state so you can get back on the roads and get your life back. Shopping around for the best insurance rates is one of the best ways you can save on the cost of auto insurance after DUI.

Car Insurance Calculator

There are several factors that are involved in the equation. Some of these factors are within your control, and some are not really up to you. Although the rate quotes you will get from different companies will vary quite a bit, at least this will give you an understanding of what goes into determining what your rates will be. You’ll be able to use our car insurance calculator above to find and compare prices.

- Driving Record– Obviously this is a big factor in determining what your auto insurance premium rates will be. Anyone who has been able to keep their record free from tickets and accidents can expect your rates to be much lower, unless you are a new driver without any record at all.

- First time drivers and those with multiple infractions are more likely to be considered high risk, which means rates will be higher. After three years minor tickets and accidents usually come off your record, so be sure to alert your insurance carrier so they can adjust your premiums accordingly.

- Driver’s Age– Younger first time drivers are among the highest premium rate classes because inexperience puts you at a greater risk for accidents.

- Many young drivers are included in their parents’ policy as an occasional driver to help keep costs lower.

- Doing other things, including taking driver’s education class in school, can also help lower your premiums.

- Generally the rates only decrease slightly until around age 21 or after marriage, as long as the record stays clean. Age 25 or marriage is when you begin to see an even bigger drop in premiums as long as the record is clean.

- Type of Vehicle– When it comes to the type of car you are driving, there are a lot of details that can impact the cost of your policy when you use the car insurance calculator.

- For one thing, if the car is brand new and financed this is where you will find your highest car insurance rates because you must have different types of coverage including collision, comprehensive and usually gap insurance as well.

- Obviously there is even a difference based on whether you are driving a convertible sports car or a sensible family four door. Color can sometimes have an effect on the costs as well.

- Most importantly, you can see some savings if you have safety features and anti-theft features included. Choose antilock brakes and air bags over a DVD player, and your insurance won’t be quite as high.

- Use for Vehicle – If you are simply driving your car to an office job five minutes away as your primary use, the rates for insurance will be lower. If you drive a great distance or use the vehicle for work, as in delivery work, then you will have to carry greater coverage that will also cost a bit more.

- Location of the Vehicle– Surprisingly where the vehicle is located and kept at night is also a major factor in pricing your policy rates.

- For one thing, each state has different minimum requirements, so your state could cost you more or save you money on insurance.

- Next, even your zip code impacts the cost because it will give data about the rate of accidents, crime and even road hazards such as construction.

- Finally, where you park your car when you are not using it will have an impact on the cost. For example, if you live in a quiet cul-de-sac with low crime and park your car in a garage so it is safe from even potential damage from storms, your rates will reflect this. Parking on the street in a neighborhood with higher crime rates and the vehicle exposed to the elements will cost you more for insurance protection.

There are other factors involved, and sometimes it depends on the company you are dealing with. For instance, some companies offer lower rates for those with better credit scores because it means you are more likely to keep your policy paid for and activated. It could also mean you are less of a risk for tickets and accidents.

If you have had gaps in your insurance coverage history, you are also likely to pay higher rates. Any driver who lets coverage lapse for more than 30 days is considered high risk. So even if you are not driving your own car make sure you get something like non-owners insurance coverage so you have some type of policy in place. The calculator will show the higher rates.

If you have had more serious infractions on your record, such as DUI, you may have to carry SR22 insurance to drive legally or even get your license reinstated. Rates for this type of coverage are obviously going to be steeper. So take this into consideration when you calculate your rates.

Taking Control of Your Rates

- The best way you can get rates that fit your budget is to get comparative rates. Calculating what you might expect to pay is one thing. Getting rates from different carriers to find the best deal for your coverage is the perfect method to use to see the savings you deserve.

- It was once much more complicated to compare rates. This involved contacting several different companies in your area and giving out your personal information to each one. After a few days these companies would call back and give you rates. Of course, not all of them would remember to call back so you would have to follow up on your own just to try to give them your business. It is simple to estimate car insurance prices today.

- These days the work can simply be done for you. By starting with nothing more than your zip code you can get an idea of what your rates could be. Even if you already have coverage, you should get your free quotes today to make sure you are getting the best rates possible for the coverage you want and need.

Cost of Texas Auto Insurance

With so many of us having difficulties paying all of our bills each month, it is important to be able to find ways to save money, especially on the cost of Texas auto insurance. Car insurance can be extremely expensive, especially if you have any infractions on your driving record. But, there are still many ways that you can save money and get the lowest possible insurance rates. These include:

- Combining Insurance Policies – If you own a home, you will need to have home owner’s insurance. Many insurance companies will offer discounts to customers who combine their home, auto and life insurance policies. You can often save hundreds of dollars a year by doing this.

- Take a Driver Training Course – These courses aren’t just for high school students. Anyone who wants to learn how to be a better driver can take driver’s education courses, which are often offered by your local Department of Motor Vehicles. When you have taken one of these courses, many insurance companies will look favorably on you, and you will be eligible for a discount on your coverage.

- Keep Your Record Clean – It is important that you follow all of the rules of the road every time you are behind the wheel. Most insurance companies offer safe driver discounts, so the safer you are when you drive, the better your discounts are going to be. Often, you can receive annual discounts for each year that you have a safe driver’s abstract.

- Maintain a Good Credit Rating – Many insurance companies will base their rates on a variety of things, including customer credit ratings. If you have bad credit, you may find that it is difficult to save money on the cost of Texas auto insurance. This is an excellent reason to make sure that everything is paid on time each month and that you don’t get behind in your bills.

These are just a few of the things that you can do save on the cost of Texas auto insurance. One of the most important things you can do is shop around to make sure you get the best deal. Insurance rates aren’t standard right across the board, and often you will find that some insurance companies charge a lot more for their coverage than others do. It is important that you take the time to contact a number of insurance companies, both local and national, to see which company is going to offer you the best deal.

You are required by Texas law to have a minimum amount of auto insurance coverage. But, you shouldn’t have to pay an arm and a leg in order to get the coverage you need. Find out all of the discounts that are offered by the various insurance companies, as well as what is covered, then take some time to look at each quote and figure out which insurer is going to be the best one for you to do business with. Don’t take the first policy that is offered to you, because chances are that it won’t be the best deal.

The Average Car Insurance Rates by City

Each state sets the standards of insurance sold within its borders, setting the state minimums and the rules of inclusion (who can be covered) and exclusion (who can be prevented from getting certain policies). In addition, each insurance company has the ability to set prices within those guidelines that can take into account certain factors that can increase the rate of insurance from one city to another. So, for instance, if you know that New Jersey has one of the highest insurance rates in the nation you will be prepared, but you might be shocked to know that insurance rates in one county can be several hundred dollars more than in the next county over.

The Most Expensive States for Auto Insurance

Most of the cities with high insurance rates will come from the states where prices are higher than the national average. These include:

- New Jersey

- Louisiana

- New York

- Maryland

- Michigan

- Delaware

- Rhode Island

- Alaska

- Also included on this list, the District of Colombia.

The Least Expensive States

While there might be some cities in these states that might qualify as higher than others, it is safe to assume that they are not on the top ten list. These states are:

- Hawaii

- South Dakota

- Illinois

- Iowa

- Arkansas

- Vermont

- North Dakota

- Nebraska

- Ohio

What Drives Insurance Rates Up in Each City?

There are several factors that can increase the insurance rate in each city. These can include:

- Crime rates: crimes like auto theft and dui can directly impact a city’s insurance rate

- The number of young male drivers

- The number of overall drivers

- Economic status

- The number of people per square mile. The more people that live in a confined area, the higher the likelihood of an accident

The Top Five Cities for DUI Convictions

Driving under the influence, also called by other names in various parts of the country is very costly to the insurance industry, costing billions in claims and other costs every year. In addition, it is dangerous to share the road with someone who has been drinking. Drunk drivers account for over one third of all traffic related fatalities, killing thousands of people each year. These are the five cities with the most DUI convictions on the record:

- San Diego, California

- Los Angeles, California

- Indianapolis, Indiana

- Jacksonville, Florida

- San Francisco, California

DUI convictions are costly for a number of reasons, including the cost of prosecution, the fines, possible jail time, loss of license and more. It will also impact your insurance which may already be very high simply because of the city you are living in.

Where is Insurance the Highest, By City?

On average, the cities where insurance is the highest are urban with high populations. These are the top twelve with their annual insurance rates and trends:

- Newark, New Jersey $2749, up nearly ten percent from the previous year

- New Orleans, Louisiana, $2423, down nearly eleven percent

- Wilmington, Delaware, $2391, down four percent

- Baltimore, Maryland, $2329, up just over six percent

- Providence, Rhode Island $2249 down nearly nine percent

- Louisville, Kentucky $2102 up just over five percent.

- Jacksonville, Florida, $2074, up nearly one percent

- Philadelphia, Pennsylvania $2071, down nearly ten percent

- Bridgeport, Connecticut, $2042, down just over two percent

- Detroit, Michigan $1998, down nearly six percent

- Las Vegas, Nevada $1946 down nearly eleven percent

Auto Theft: Another Factor in Raising Insurance Rates

In addition to DUI, auto theft can make a city’s insurance rate much higher. These are the ten cities with the highest rate of auto theft:

- Modesto, California

- Laredo, Texas

- Yakima, Washington

- San Diego/Carlsbad/San Marcos, California area

- Bakersfield, California

- Stockton, California

- Las Vegas, Nevada

- Albuquerque, New Mexico

- San Francisco/Oakland/Freemont, California area

- Fresno, California

These are the top ten with the lowest rate of auto theft:

- Virginia Beach, Virginia

- New York, New York

- Austin, Texas

- Arlington, Texas

- San Antonio, Texas

- Louisville, Kentucky

- San Jose, California

- Wichita, Kansas

- Colorado Springs, Colorado

- Jacksonville, Florida

Las Vegas, Nevada: An Example of Insurance Disparity

The national average insurance cost is higher than the state of Nevada’s average cost but considerably lower than that of the city of Las Vegas. In fact, the city of Las Vegas pays, on average, over seven hundred dollars more in insurance than the state average. The reason for that is simple: it is Vegas! Some reasons that the insurance in Las Vegas is so much higher than both the state and the national average:

- The population of Vegas is over fifty percent males. Insurance rates for males are higher because they are involved in the majority of auto accidents, causing over eighty one percent in Las Vegas alone.

- Of the top ten metro areas with increased risk of auto theft, Las Vegas was ranked number one.

- The city had more than two hundred fatalities, nearly seventy of which were alcohol related. Over forty percent of all accidents in the city are caused by a legally impaired driver.

- The daytime population change in the city is a + 11,117, meaning that in addition to the residents of the city, more than eleven thousand additional people come for work or recreation.

What if you are Driving to a College in Another City?

For some people, buying car insurance is a simple but expensive matter. They live in one city and that is just the end of it. For others, especially college students, there are some options. For instance, if a student lives in the dorms at their school which is in a different city, it might be cheaper to buy insurance based on that city rather than the city their parents live in even if the policy would be based on the higher rate because of the student’s age. This is a perfect example of why comparison shopping is so vitally important and should be done, looking at every possible option.